Example Of Cash Budget Question And Answer

If the cash budget highlights possible cash. From mfg overhead budget.

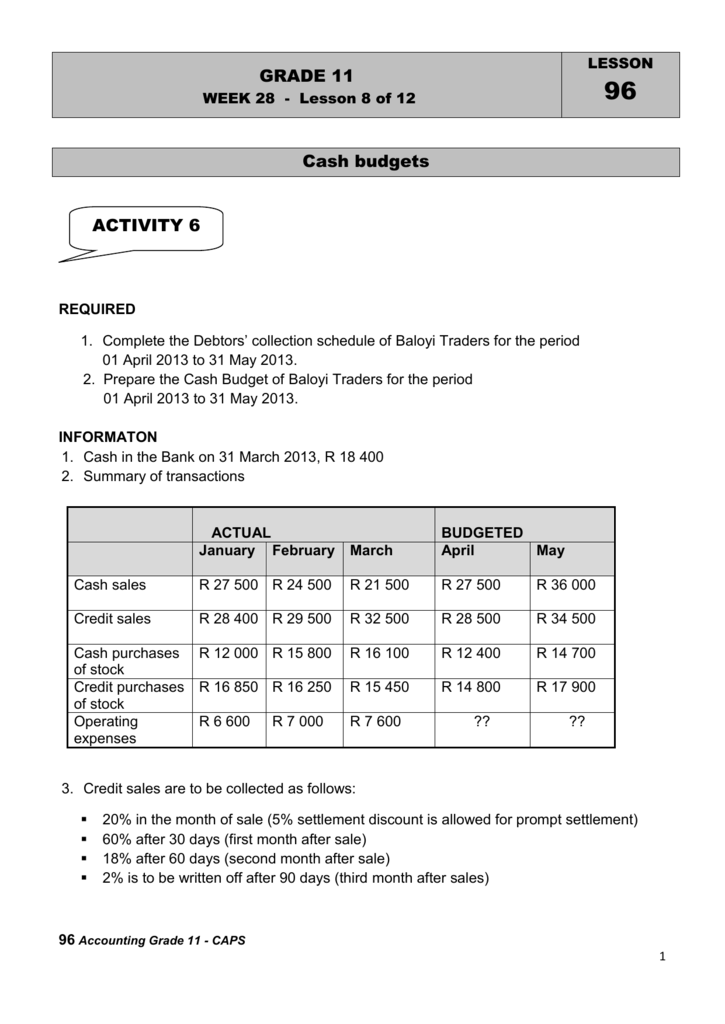

Grade 11 Week 28 Lesson 8 Of 12 Lesson 96 Cash Budgets

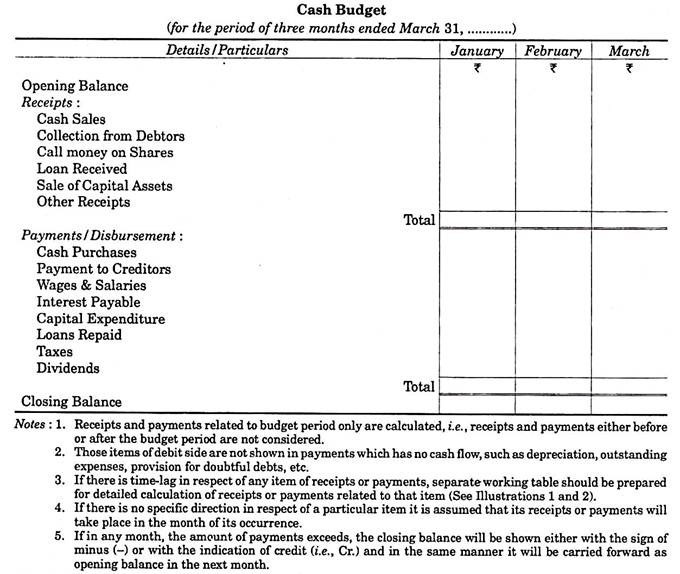

Although the sale would be recorded in the Statement of Profit or Loss in January it must appear in the March column in the cash budget.

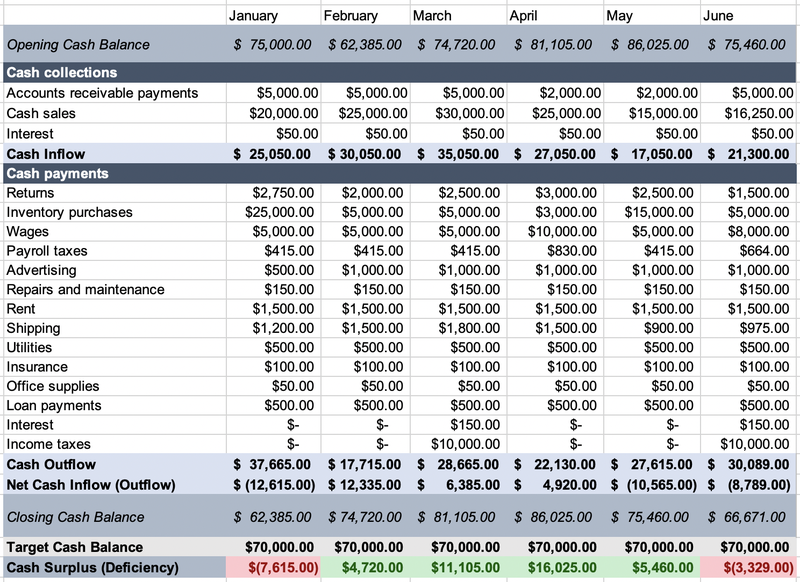

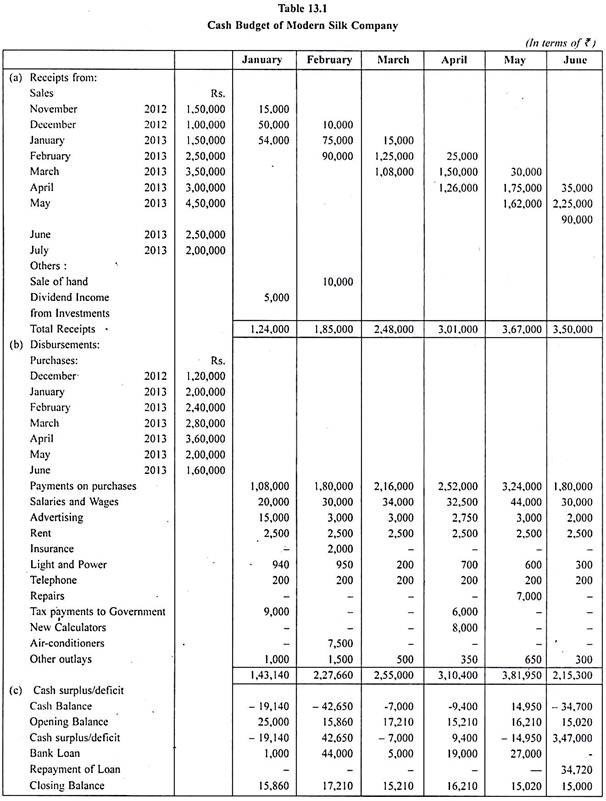

Example of cash budget question and answer. By preparing cash budget it becomes possible for the organisation to predict whether at any point of time there will be excess or shortage of cash. Based on the time of receipt or payment that we will use in our cash budget. 20000 purchase in June 25 payable immediately and the remaining in two equal installments in the subsequent months.

Selfsupporting accounts can be set up when there is an identifiable program or activity that generates its own revenue and has related costs where it is appropriate to track in a separate account. GST cash basis SOLUTION STEP 1. Month of cash collection Month of sale Jan Feb Mar Nov 128000 12800 3840 Dec 138000 111435 13800 4140 Jan 94000 75905 9400 Feb 114000 92055 Mar 132000.

For example if a companys cash budget forecasts itemized inflows income of 1000000 and itemized cash payments expenses of 800000 management can feel fairly certain that it will have enough cash to pay all of its bills. Budget Questions and Answers Q1. So heres the income bit first.

For example if a cash budget discloses a budget period where a cash shortfall is likely then management can plan for this situation and ensure the necessary funds are available for the business to get through this period. Budget includes only actual cash flows. Jul Aug Sep Oct.

This can lead to serious liquidity issues if not managed properly. Managerial Accounting Test Paper Questions On BUDGETING E-BOOK _____ Page 14 ˇ ˆ ˇ ˇ ˇ ˆˇ 4 8 9. A cash budget allows companies and individuals to evaluate income versus expenses.

Cash Budget for Woods Ltd July - December 2011. There are actually two slightly different types of cash budgets so the one Ive explained here is. It is an estimation of the expected cash receipts and cash payments during the budget period.

Maintaining a desired. The best way to explain the answer is simply to show it to. Cash payments for selling and admin.

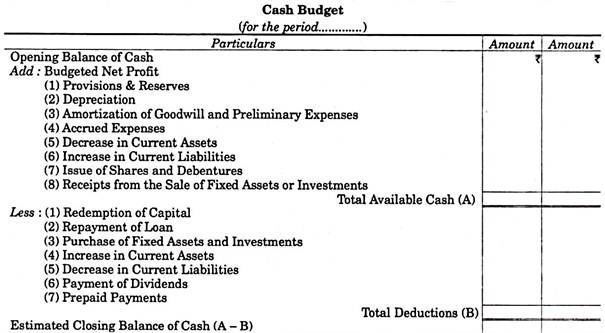

Cash budget is the budget which is prepared under the finance budget. Cash payments for mfg overhead. From selling and admin budget.

Calculate cash collected from Accounts Receivable including any discount allowed. When can a New Account be set up. What does a cash budget provide us with an estimate of.

The GST and cash budgets 6. How to approach a question in the exam which asks you to prepare a cash budget. Cash payments for Income Taxes.

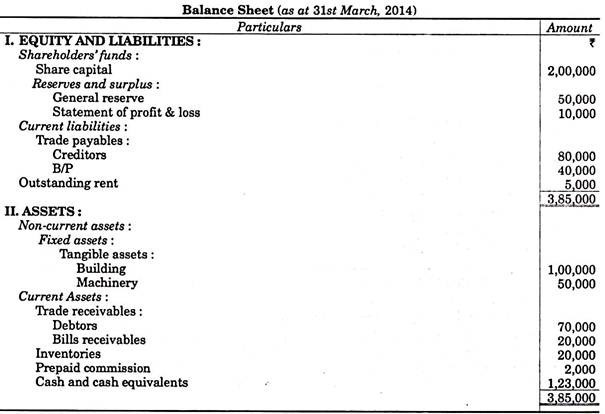

Calculate a firms expected total cash collections and disbursements for a. A cash budget is an estimate of cash flows for a period that is used to manage cash and avoid liquidity problemsThis involves estimates of revenue costs and financing activities as they occur at points in time. In order to continue as a going concern an entity has to make sure it has sufficient amount of cash available to meet its current liabilities.

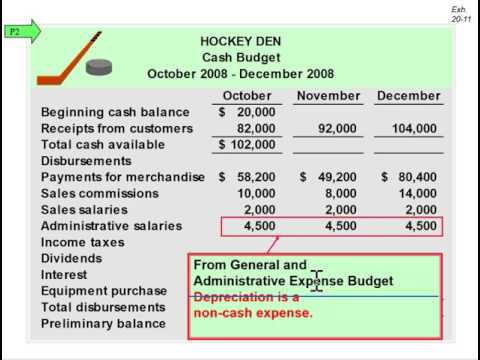

For example depreciation expense a noncash expense does not appear on the cash budget but principal payments on debt obligations After studying this chapter you should be able to. Cash budgets - OVERVIEW 7. If an existing account is available and appropriate it should be used.

From direct labor budget. Cash budget is an important tool for effective controlling and planning. Advance payment of tax payable in Jan and April Rs 6000.

Explain the purpose of the cash budget and how it differs from an income statement. For example expenses such as labour materials and overheads may have to be paid out before the cash from the sales arrives. Is a cash budget and a budgeted cash flow statement the same thing.

The following are illustrative examples of a cash budget. From budgeted income stmt. Given in information above.

Why Does a Cash Budget Matter. What does a cash budget look like. It is a key tool in keeping the overall working capital management in strict control.

Cash payments for dividends. From the estimates of income and expenditure prepare cash budget for the months from April to June. The expenditure bit and the net cash bit.

For example if credit sales of 10000 were made in January on two months credit then the money would be received in March. If the metal box company has a labour cost equal to 20 of the sales value a materials cost equal to 25 of the sales value and an overhead cost equal to 15 of the sales value then the functional budget would be as.

Prepare A Cash Budget For January And February In Chegg Com

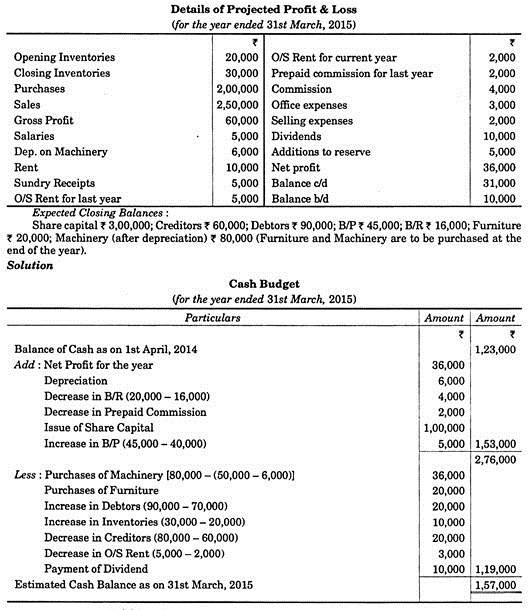

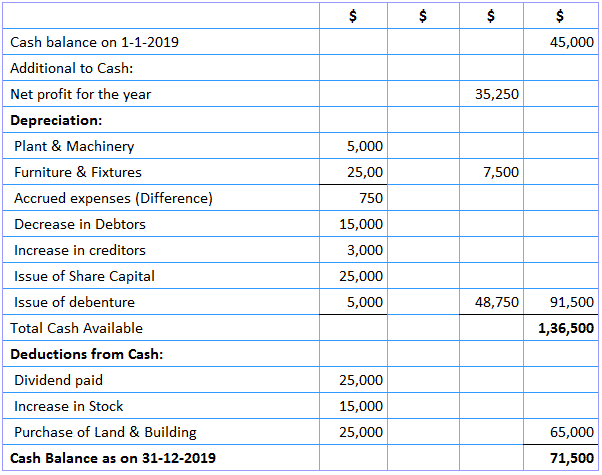

Cash Budget Methods 3 Methods Of Preparing A Cash Budget

Cash Budget Methods 3 Methods Of Preparing A Cash Budget

Cash Budget Methods 3 Methods Of Preparing A Cash Budget

Cash Budget Methods 3 Methods Of Preparing A Cash Budget

Cash Budget Preparation Definition Components Template Example

Cash Budget In Accounts And Finance For Managers Tutorial 01 September 2021 Learn Cash Budget In Accounts And Finance For Managers Tutorial 9136 Wisdom Jobs India

Preparing A Cash Budget Youtube

Cash Budget Format And Its Explanation With Solved Example

7 5 Cash Budgets India Dictionary

Cash Budget Format And Its Explanation With Solved Example

Cash Budget In Accounts And Finance For Managers Tutorial 01 September 2021 Learn Cash Budget In Accounts And Finance For Managers Tutorial 9136 Wisdom Jobs India

How To Prepare A Cash Budget For Your Business The Blueprint

How To Plan Create Budgets Budget Variance Analysis Steps

Cash Budget Preparation Definition Components Template Example

Cash Budget Methods 3 Methods Of Preparing A Cash Budget

Cash Budget Methods 3 Methods Of Preparing A Cash Budget

Cash Budget Example Accounting Education

Post a Comment for "Example Of Cash Budget Question And Answer"